Introduction

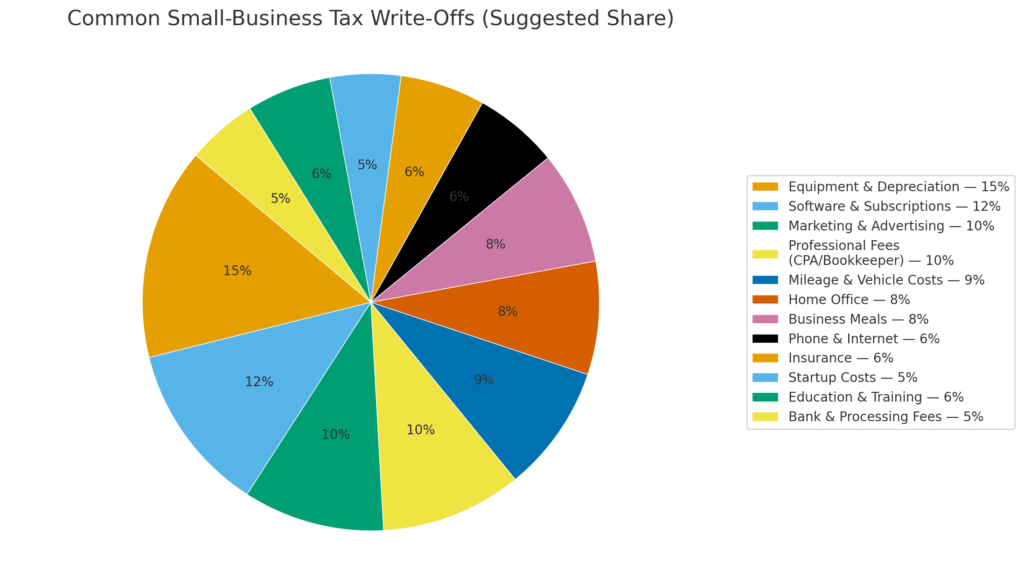

Tax write offs lower your taxable income. That means you may pay less tax. Most owners miss deductions because they do not track them during the year. Here is a clear list and a simple way to stay on top of it.

How to track write-offs all year

Simple records checklist

- Bank and credit card statements

- Invoices and receipts with dates and vendor names

- Mileage log

- Fixed asset list

- Vendor W-9 forms if you pay contractors

When to get help

If categories look messy, balances seem wrong, or you are behind on bank reconciliations, get a cleanup. Clean books make deductions easier to support.

Disclaimer: This article is for educational purposes. It is not tax advice. Talk with a qualified tax professional for your situation.