Introduction

You do not need dozens of reports. You need a small set that helps you decide what to do next. With a few reports and a short cash flow forecast, you can plan, grow, and avoid surprises.

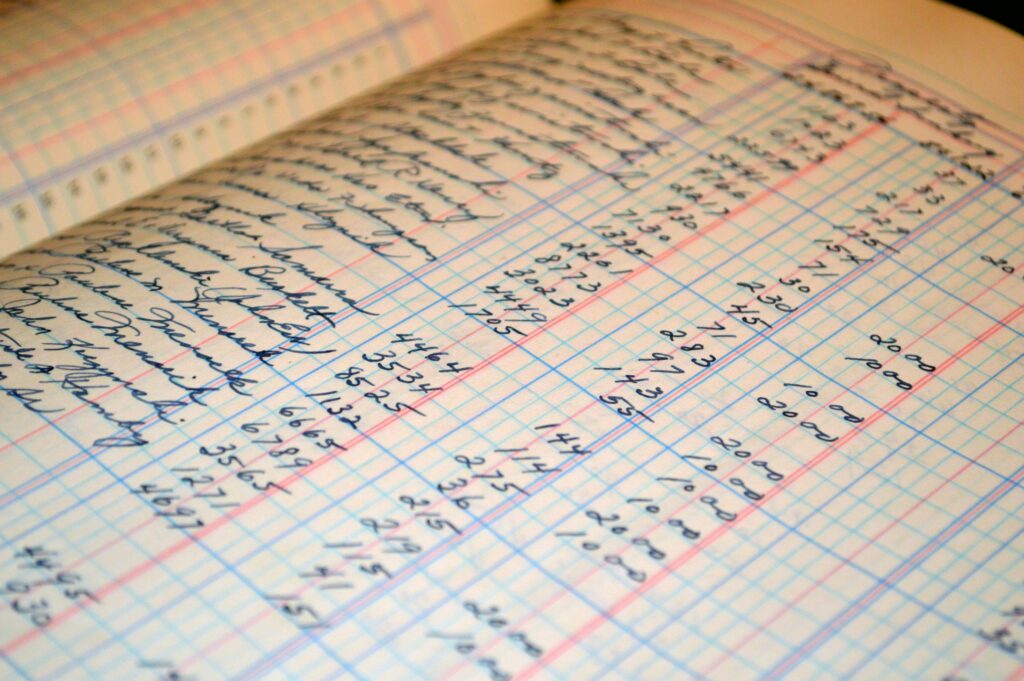

The three core reports

- Profit and Loss

Shows income and expenses for a period. Use it to track gross margin, compare months, and find costs to reduce. - Balance Sheet

Shows what you own and what you owe on a date. Use it to monitor cash, receivables, payables, loans, and inventory. - Cash Flow Statement

Shows how cash moves in and out. Use it to see if profit is turning into cash and to plan for taxes, payroll, and purchases.

Build a simple 13 week cash flow forecast

- Step 1. Starting cash

Use today’s bank balance. - Step 2. Expected inflows

Add weekly sales you expect to collect and customer payments that are due. - Step 3. Expected outflows

List payroll, rent, loan payments, inventory, taxes, and other known bills.

Update the forecast every week. If cash looks tight, adjust plans before there is a problem. Delay a purchase, start a promo, or collect receivables sooner.

Pick a few KPIs and review monthly

- COGS percent

- Labor percent

- Average ticket or revenue per job

- Customer frequency or utilization

- Net profit margin

Examples by business type

- Food and QSR

If COGS is high, audit waste, portioning, and vendor pricing. Add a short weekly inventory count. - Franchise operator

Compare store level Profit and Loss reports. Shift labor or promotions to match demand. - Handyman and services

Track revenue per job and materials markup. Improve scheduling to raise billable hours per week.

Make reports useful with a simple loop

- Review the three reports

- Update the 13 week forecast

- Choose one or two actions for the next month

- Measure results next month

Call to action

Want reports that are clear and a forecast you can update in minutes? Book a free consultation with TrueBooksNow. We set it up and show you how to use it.